France will soon be phasing in countrywide mandatory e-invoicing and continuous transaction controls (CTC) – what does that mean for your organization? Find out important dates, obligations, and what you need to know about connecting to the Public Invoicing Portal and the use of Partner Dematerialisation Platforms (PDPs) when operating in France or with French businesses.

Table of contents

- Latest update (as of December 17, 2024)

- Overview of the mandate

-

E-invoicing in France

-

The obligations (e-invoicing for businesses)

- Peppol & Pagero

-

ViDA (VAT in the Digital Age)

- Pagero in France

- Glossary

Latest update (as of December 17 2024)

Important note: La Loi de Finance (The Finance Law) of 2024 is currently unfinished and is subject to change and modifications prior to its finalization and enactment. This blog is amended and updated after each publication by the French Government, DGFiP and AIFE.

Peppol Authority for France to be created

The French Administration will become a Peppol Authority for France in the coming months. The creation of the Peppol Authority marks an essential milestone in developing the French CTC mandate. Read more.

Find out all the latest updates on France (and other countries) in our regulatory updates page.

Overview of the French Invoicing market

Pagero’s historical experience with the French Government in establishing, maintaining, and providing ongoing e-invoicing processes and acting as a single Peppol access point on the receiving side for the French State demonstrates Pagero’s solid foundation since 2017 with not only Peppol but Chorus Pro, too (processing between 10,000 and 20,000 B2G invoices per month for the French Government).

Pagero is proactively involved in the development of solutions for the French Mandate e-invoicing model. The French Government’s ‘return document’ has been developed exclusively by Pagero, demonstrating Pagero’s existing ability to manage all return messages and other associated messages and statuses for all B2G transactions through Peppol, of which Pagero is one of the largest providers worldwide.

General Information about the French Mandate

Up-to-date implementation timeline (updated 23 April 2024) :

2025: Start of pilot phase (116 companies)

2026 September 1: Reception of e-invoices mandatory for all taxpayers, regardless of company size. Mandatory for large and medium-sized companies to issue e-invoices and carry out e-reporting. (~7,000 companies)

2027 September 1: Mandatory for intermediate, small, and micro enterprises to issue e-invoices and carry out e-reporting (~ 4,000,000 companies)

TO : Turnover | BS : Balance sheet | FTE : Full time employees

Non-compliance penalties:

- E-invoicing: 15 euros per invoice, capped at 15,000 euros per year

- E-reporting: 250 euros per transmission, capped at 45,000 euros per year for PDPs. There is no cap for standard taxpayers.

Service providers:

- 116 candidates are taking part in the pilot phase

- 70 registered PDPs, with more to come

- 17 service providers connected to the PPF (Portail Public de Facturation / Public Invoicing Portal)

Authorised formats:

- Factur-X

- UBL 2.0

- CII

- PeppolBIS

- EDIFACT

Technical advances relevant to the mandate

Progress in interoperability

- Phase 1 of the DCTCE (decentralised CTC exchange) POC confirmed compatibility between Factur-X and EDIFACT

- Phase 2 & 3 in development

- 51 participants collaborating on this proof of concept

- 43 FNFE-MPE members (Pagero is a member since 20XX) contributing to the standardisation of norms.

- 35 PDP candidates to participate in this DTCE POC.

What is meant by “electronic invoice” according to the French mandate?

According to the planned framework, only structured formats will be considered valid e-invoices for fiscal purposes. The DGFIP plans to regulate the use of a number of formats via the PPF and PDPs, as long as they are compatible with the European Norm.

Among the permitted formats are UBL 2.1, UN/CEFACT CII and Factur-X. Initially, only these three formats were permitted but other formats such as Peppol BIS and EDIFACT have been added.

This means that by 2027, paper and simple PDF invoices will no longer be valid in France.

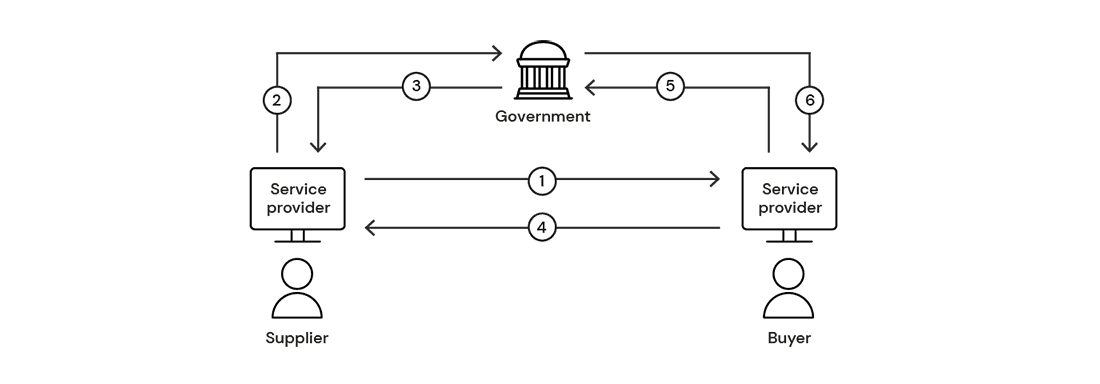

The 5-corner model

The Y-model was initially the chosen method for e-invoicing in France, with the PPF at the center - providing 3 methods of fulfilling obligations related to the mandate (via the use of an OD, a PDP, or the PPF).

However, according to the announcement from the DGFiP, the role of the public invoicing platform (PPF) is being shifted towards data collection and aggregator, and will no longer have a central role in the distribution of invoices between buyers and suppliers.

In short, France is moving from a hybrid invoicing model with a central platform and decentralized certified service providers (PDPs) towards a pure 5-Corner model only using the PDPs for invoice distribution and data extraction. The PDPs will be responsible for facilitating transmission between buyers and suppliers and handling the e-reporting of the transactions to the PPF.

This means that software providers and businesses who intended to connect directly to PPF to exchange invoices will no longer be able to do so. Instead, they will have to contract the services of a PDP platform.

This model is a mix of the DCTCE and Centralized Exchange models. Currently, this model is present only in France.

The 5-corner model is a sub model of the decentralised model, one of three main e-invoicing models:

- Interoperability Model

- Centralised Model

- Decentralised Model

The 5 Corner Model integrates elements of both decentralized and interoperability frameworks. In this model, service providers must be certified by the tax authority and are responsible for clearing invoices they receive. Additionally, the service providers for suppliers must ensure that invoices reach buyers either directly or through other certified providers. This setup requires service providers to establish connections with other providers operating in the market. Once these steps are completed, the service providers transmit the processed invoice data to the tax authority.

This model places significant responsibility on service providers, as they manage more tasks compared to other models. By taking on these operational duties, service providers reduce the workload of tax authorities, allowing them to focus on processing tax-relevant data rather than providing extensive support or maintaining platforms. Proponents of the 5 Corner Model argue that it promotes greater efficiency in the market since private enterprises can innovate at a faster pace than public institutions.

French mandate: The latest essential updates

Timeline for the French e-invoicing and CTC mandate

Now that B2G (business-to-government) e-invoicing is underway in France, the country has set its course on a countrywide e-invoicing and e-reporting mandate.

According to an announcement from the Council of Ministers, e-invoicing will become mandatory for all companies subject to VAT in France starting in 2025 with the pilot phase. Domestic B2B e-invoicing will become mandatory for large and medium businesses in 2026, with intermediate, small, and micro businesses following in 2027.

Changes will be introduced according to the following timeline:

From 2025: Pilot phase expected to start.

From 1 September 2026: All taxpayers must be able to receive e-invoices. Mandatory for large and medium-sized companies to issue e-invoices and do e-reporting.

From 1 September 2027: Mandatory for intermediate, small, and micro companies to issue e-invoices and do e-reporting.

When is it mandatory for large companies?

Timelines for implementation of other document types and e-reporting schemes are still pending clarifications from DGFIP (the General Directorate of Public Finance). These dates may be subject to being extended by one quarter if needed, without Parliamentary approval.

What is Chorus Pro? The B2G e-invoicing portal

France started introducing mandatory B2G e-invoicing for suppliers to government entities in 2017. The French government chose Chorus Pro as the official and obligatory platform for businesses to issue e-invoices to public administrations. Since January 2020, all suppliers to the public sector (B2G) have been required to issue invoices electronically. Chorus Pro is the B2G e-invoicing portal of the French Government, whilst the PPF is the B2B e-invoicing portal for all companies established or operating in French territory.

Note: The PPF will be the public invoicing portal for all B2B e-invoices and will be directly connected to the current government hub for B2G e-invoicing, Chorus Pro. The PPF is not Chorus Pro.

On-demand webinar

What is a PDP?

Partner Dematerialisation Platforms (PDP): a Partner Dematerialisation Platform will be an independent service provider, approved and recognised by the government. With this certification service providers will be allowed to issue and receive e-invoices directly through the service provider of the counterparty without going through the PPF, provided that the other service provider is also a PDP.

This is an advantageous option for businesses concerned about single-platform failure, which could happen if the PPF were to be offline.

What is a PDP’s role:

- Transmit e-invoices or lifecycle statuses to the PPF.

- Send e-invoices to other PDPs and report a subset of this data to the PPF if the recipient uses another PDP and has an interoperability agreement. If the recipient is not using a PDP, the issuing PDP will send the tax invoice to the PPF, who will transmit it to the recipient.

- Facilitate the reporting of transactions that fall into the French e-reporting mandate. Mainly Cross-border B2B transactions and domestic B2C transactions.

- Convert e-invoices into one of the three standard, mandatory formats (Factur-X, UBL 2.1 and UN/CEFACT CII) to ensure compliance with EU norms.

As the intermediary between a supplier and a customer, the PDP can convert the format of the invoice established by the supplier to the format requested by the customer. These operations will be carried out under strict conditions to ensure the preservation of the integrity of the data, its authenticity, and its exhaustiveness.

A PDP must adhere to many regulations and requirements as part of the certification process.

What is a PDP, OD and the PPF?

The sooner you implement digital processes into your daily operations, the more prepared your business will be to start e-invoicing via the Public Invoicing Portal (the B2B version of Chorus Pro (B2G)) through the use of PDPs. You will need to ensure you are ready for e-invoicing but where to start?

There used to be several different methods for sending and receiving e-invoices and the life cycle status of an e-invoice under the new guidelines in France, such as directly through the PPF, via an OD or a PDP.

Since the change from the Y-model to the 5-corner model, the only accepted method for sending and receiving e-invoices is now through the use of a PDP (partner dematerialisation platform).

In short, there is one main method for e-invoicing in France: PDP(s).

What is The Directory's role?

The Directory is a centralised database administered by the PPF. All taxpayers will need to be registered within the central directory. The central directory will contain the necessary data to ensure the correct routing of the e-invoices and enable the identification of each e-invoice recipient's chosen platform.

Identification in the Directory is based at least on the French SIREN number. If the entity wishes, a finer identification based on the SIRET should also be possible.

The Directory is critical to facilitating the exchange of e-documents between the different platforms and service providers in the French model.

SIREN and SIRET numbers

When registering a business in France, suppliers obtain specific identification numbers from the French tax authorities. These tax ID numbers can be broken down in the following way:

SIREN number (Fr. Système d’identification du répertoire des entreprises): A nine-digit business ID number issued by the French Institute of Statistics and Economic Studies, or INSEE. The SIREN number authorizes a company to issue invoices and operate in the market. It is given only once and is valid until the death or activity cessation of a natural person or liquidation and dissolution of a legal person.

SIRET number (Fr. Système d’Identification du Répertoire des Établissements) is a 14-digit establishment identification number allocated by INSEE. The first nine digits correspond to a company’s SIREN number and are followed by an additional five digits that indicate an internal classification number, or NIC (Fr. Numéro Interne de Classement). These five digits indicate the geographic location of the company’s headquarters and other possible establishments. Each establishment of the company gets a separate SIRET number.

All businesses possessing a SIREN number fall under the scope of the upcoming e-invoicing mandate in France.

“The sooner you implement digital processes into your daily operations, the more prepared your business will be to start e-invoicing through a PDP via Chorus Pro, or the PPF.”

What are the obligations for businesses in France?

All companies subject to VAT and established in France, will have to electronically issue and receive the following documents:

- B2B Domestic invoices incl. invoice life-cycle statuses:

- Invoices, self-billed invoices, prepayment invoices, corrective invoices;

- Credit notes;

- B2B invoice responses;

All documents issued electronically must also be archived electronically. The mandatory retention period in France is 10 years.

Not only will taxpayers have to issue, exchange and process the above documents electronically, but they will also have to electronically report the following documents in near real-time to the tax authority.

- B2B cross-border (export and import) invoices;

- B2C receipts: domestic and cross-border; and

- B2B/B2C payment statuses for sales of services both domestic and cross-border.

It is worthwhile to point out that the invoices subject to e-reporting are not mandated to be issued in a structured electronic format, unlike the case with domestic B2B invoices. This means you can still issue these invoices in non-structured formats such as PDFs.

To comply with the French CTC mandate you will have to choose a PDP to exchange invoices.

- Issue and receive e-invoices via a PDP, who will do the rest: distribute the e-invoice to the buyer through the PPF or the buyer's PDP.

As mentioned above, for e-reporting (cross-border and B2C invoices), there will be two different actions: reception or issuance of the invoice in any format and then e-reporting of the transaction to the PPF (electronically and in structured format). These actions can be done by PDPs. Some PDPs cover both actions, but this is something to be agreed upon between the taxpayer the PDP (not regulated). You also do not need to use the same PDP for everything, you can issue an invoice yourself and have a PDP e-report this invoice. The options for e-invoicing and e-reporting are flexible.

How to fulfil the obligations of the French e-invoicing mandate

Even though all details of the new infrastructure are not yet finalized, the French regulator foresees one method for businesses to fulfil the e-invoicing and transaction reporting obligations.

E-invoicing via certified private platforms (PDPs)

The taxpayer will be able to contract services a of PDP that will handle not only issuance, exchange (interoperability) and receipt of e-invoices but also handle the real-time reporting obligation. In this scenario, only the VAT-related subset of the e-invoice will be reported to the PPF. The complete e-invoice will be exchanged between trading parties in the agreed format.

How can companies start preparing for e-invoicing?

If you are based in, or operate within France, the sooner you implement digital processes into your daily operations, the more prepared your business will be to start e-invoicing via PDPs. You will need to ensure you are ready for e-invoicing, but where to start?

The receipt of e-invoices will be the first regulation to enter into force for businesses of all sizes. Even though not all details of the requirements are set, it is important to start preparing your organization for the upcoming digital transformation project. We recommend implementing an AP Automation solution that can help digitalize and streamline your supplier invoice handling, regardless of what systems you currently use.

Similarly, an AR Automation solution can help you prepare for the mandate by digitalizing the distribution of customer invoices.

Expert guide: Top 5 ways to prepare for the French e-invoicing mandate

How to make the transition to e-invoicing with ease

How to make the transition to e-invoicing seamlessly:

- Evaluate existing processes: identify where you have inefficiencies

- Choose the right software: various solutions for varying goals

- Training: prepare your team for the switch

- Pilot phase: select a small group of clients to test and tweak your e-invoicing process

- Data migration: transfer all relevant data to your new system

- Communicate: with your clients what changes are implemented and how this may affect already-established processes

- Full implementation: after perfecting your new system, company-wide roll-out

- Review & refine: periodic checks & updates if necessary

Pros and cons of e-invoicing

Main pain points for companies:

- Set-up time & monetary costs of e-invoicing / Set-up time and monetary costs of a fully automated business process

- All suppliers/buyers must be able to send/receive e-invoices

- Ensuring all your suppliers/buyers are compatible with your standardized formats

Main advantages :

- Savings: time & money (shipping, personnel, materials).

- Paper-based invoicing process avoided, operating costs reduced.

- No more printing/printing supplies, or postage/delivery, or physical archiving, manual labour. (replaced by automation & instant delivery).

- Faster & more efficient payment due to faster and more efficient processing.

- Reduction of input errors – no more human errors.

- Simplified archiving – no loss of invoices/data.

- Real-time insights and overview of company processes (if all business process have been automated = full automation).

- Easy tracking: real-time tracking of invoices. E-invoicing allows a real time overview of supplier invoices.

- One-time reporting of B2B invoices. With e-invoicing, invoices are only required to be reported once.

- Bulk invoicing: with e-invoicing, you can send more than one invoice at a time.

- Post-emission corrections: Digital platforms/service providers will allow you to correct any invoice almost instantly and resend it – no need to draft a new invoice from scratch or wait for the previous invoice to be received.

- Enhanced security and reliability.

- Encrypted transfers – every invoice is sent encrypted, rendering unauthorized access almost impossible.

- Secure storage – robust preventative security measures to safeguard stored data.

- Reliable backups – multiple copies and servers.

- Greener, more sustainable processes.

- Reduced deforestation.

- Lower carbon footprint.

- Less waste.

- Conservation of resources.

E-invoicing is better for the planet and for you (more reliable). It’s the smart choice for businesses, wallets, and our planet. Choosing a single service provider illustrates this over many – 1 global provider vs many local providers. (Real-time insight and an accurate overview of all business processes is far more difficult and more costly to achieve with many providers as opposed to a single global provider.

Pagero and Peppol

Pagero is committed to spearheading digital transformation in Europe and promoting Peppol CTC globally as the optimal model for e-invoicing CTC compliance and business process automation.

The Nordic region pilot showcased real-life application of Peppol CTC (5-corner or DCTCE) model to comply with both the e-invoicing and digital reporting requirements (DRR) [jointly referred to as “CTC”] for intra-Community sales and purchase invoices under the ViDA (VAT in the Digital Age) proposal by the EC (European Commission).

The pilot involved active participation of the five Nordic tax administrations: Denmark, Finland and Sweden (EU side), Iceland and Norway (non-EU), effectively demonstrating that the model can as well be applied to export and import transactions and not only intra-community or domestic transactions.

Find out more about what Peppol is and its gradual adoption throughout the globe, as well as e-invoicing and CTC compliance in the context of digital tax controls.

Pagero remains committed to playing a leading role in driving the adoption of digital solutions and shaping the future of administrative processes globally (and locally).

“Being the lead architect behind Peppol CTC and DCTCE approach to e-invoicing compliance, we are excited to see that our hard work starts bearing fruits.”

Nazar Paradivsky, VP Regulatory Affairs, Pagero

France and the ViDA proposal

Looking at the French e-invoicing model on a high level regarding the VAT in the Digital Age (ViDA) proposal, which is expected to come into effect in 2025-2030 throughout Europe, there are some question marks of the compatibility of the French mandate with the proposal in its current form. While certain aspects of the French mandate are partially aligned, others are not. Check out our ViDA proposal guide for more information on this topic.

For more information about how to prepare for the upcoming French mandate, feel free to contact us; we will help tailor a solution to your business needs.

ViDA and the future of e-invoicing in Europe

What is the VAT in the Digital Age initiative (ViDA)? With ViDA entering effect sooner rather than later, all companies within the European Union, will have to adhere to an e-invoicing/CTC mandate in the country they reside in, and if they operate in other countries, they will have to adhere to those mandates.

If a company has to adhere to one mandate, it will have to adhere to all other mandates as per ViDA. International e-invoicing will become obligatory and the norm for all companies exporting or importing anything. Through Pagero, a single connection, will provide unlimited access and superior automation, compliance and efficiency.

Here is a brief overview of other mandates coming into effect in the European Union:

And here is an overview of the VAT in the Digital Age initiative (ViDA).

Pagero in France

With established operations and teams in France, Pagero is compliant with the current requirements for e-invoice issuance, exchange, and receipt as well as e-archiving and e-signature. We also aim to obtain the status of certified private platform, pending publication of the final regulations by the DGFIP.

Our qualifications:

- Connected to Chorus Pro since 2016

- The single Peppol Service Provider for Chorus Pro since 2019

- Member of FNFE interoperability charter since 2020

- Participant in testing of Chorus Pro B2B capabilities

- Actor in the Peppol PoC (Proof of Concept)

About Pagero

Pagero provides a Smart Business Network that connects buyers and sellers for automated, compliant, and secure business communication. With a commitment to innovation and sustainability, Pagero works alongside governments, businesses, and technology partners to drive digital transformation worldwide. For more information, visit www.pagero.com

Glossary

B2G : Business-to-government

B2C : Business-to-customer

B2B : Business-to-business

PDP : Partner dematerialisation platform, (FR: Plateforme de dématérialisation partenaire)

OD : Dematerialisation operator, (FR: Operateur de dématérialisation)

PPF : The public invoicing portal, (FR: Portail public de facturation)

DGFIP : The General Directorate of Public Finance, (FR: Direction Générale des Finances Publiques)

AIFE : Agency for State Financial IT, (FR: Agence pour l'Informatique Financière de l'Etat)

EDI : Electronic data interchange

API : Application programming interface

SIREN : Business Directory Identification System, (FR: Système d’identification du répertoire des entreprises)

SIRET : System for the Identification of Establishment Directories, (FR: Système d’Identification du Répertoire des Établissements)

CTC : Continuous transaction controls

DRR : Digital reporting requirements

DCTCE : Decentralised CTC exchange

FNFE : National Forum on Electronic Invoicing, (FR: Forum National de la Facture Électronique)