TicketBAI e-invoicing

Fulfil the TicketBAI mandate requirements by generating, sending and reporting compliant invoices to the Basque Tax Administration with Pagero.

What is TicketBAI?

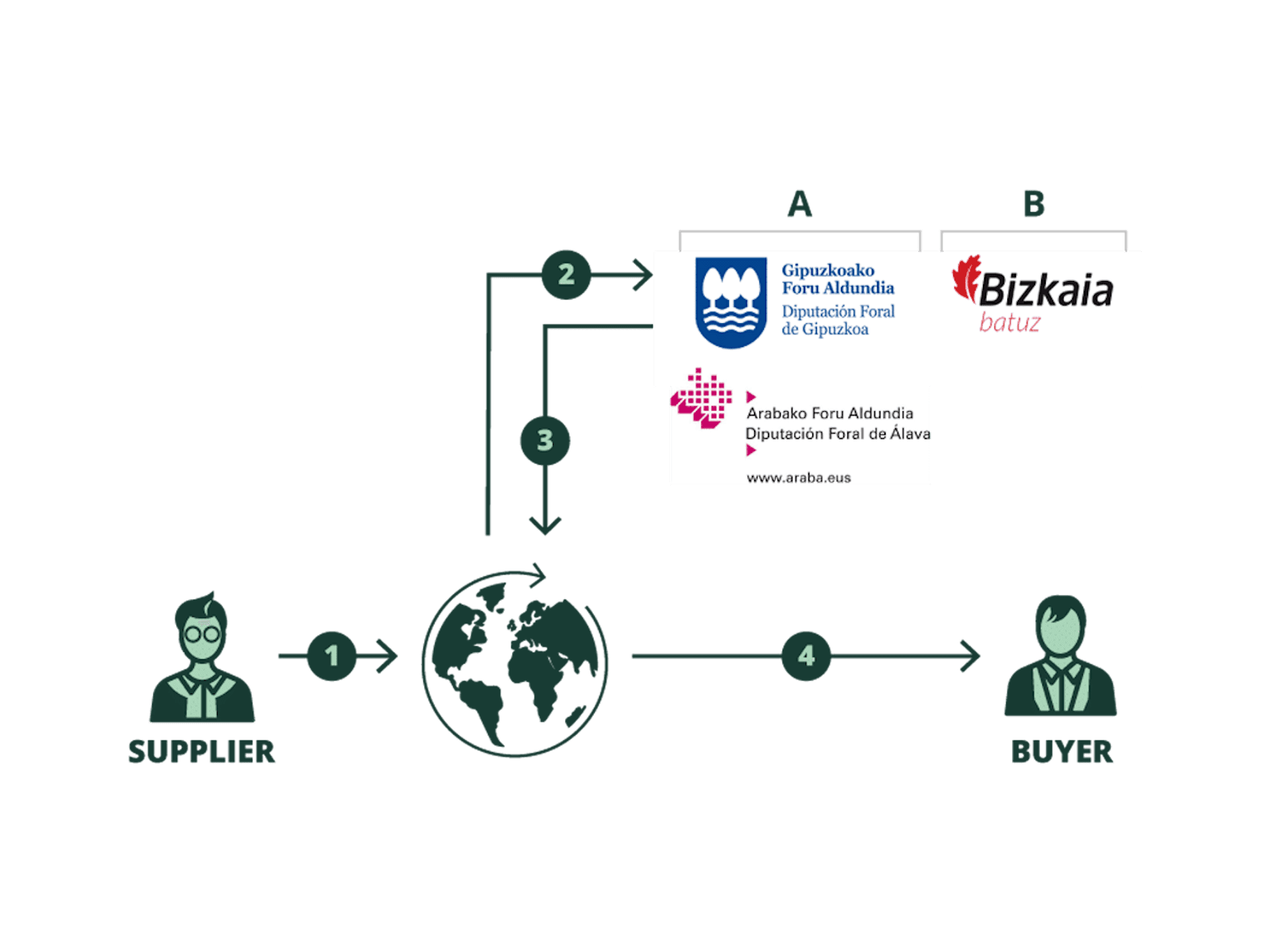

TicketBAI, also known as TBAI, is an e-invoicing mandate introduced by the tax authorities in the Basque Country. The mandate covers all three Basque regions (Álava, Gipuzkoa, and Biscay) and establishes legal and technical obligations for individuals and entities that carry out economic activities. Individuals and entities in the scope of the mandate will be required to use software (or hardware) to report invoice data to the Basque Tax Administration in real-time.

Watch our webinar for more insights

In this webinar, we navigate the new TicketBAI regulations and make sense of their complexity.

Our TicketBAI e-invoicing solution provides:

- Quick implementation

- Generation of TicketBAI XML with e-signature

- Reporting in real-time to the relevant tax administration

- Invoice distribution with QR code and TBAI code (UUID)

- One single invoice flow as Pagero distributes invoices and reports them to the relevant tax authorities

- Transition to a fully integrated solution with your existing ERP/finance system

Compliance is easy with Pagero

Connect to Pagero today to fulfil the TicketBAI mandate requirements and streamline your business processes.

Learn more about TicketBAI

Discover all you need to know about the TicketBAI mandate and how Pagero helps you to fulfil the requirements.

Keep up with the latest e-invoicing regulations

Stay up to date with developments in Spain and in other parts of the world with our constantly updated overview of global e-invoicing regulations.

FAQ about the TicketBAI mandate

Start your TicketBAI software journey with Pagero today

- Comply with the Basque Tax Authorities’ requirements

- Communicate electronically with all your clients and suppliers

- Transition to a more efficient financial department